The efficacy of a wealth-building solution is measured by the return generated, but a nuanced approach is needed because savvy investors understand the value of one dollar today is different than the value of one dollar five years from now. Therefore, multiple measuring sticks are needed to define a successful investment.

Fortunately, we use two primary metrics to define success for our private real estate investment opportunities: internal rate of return (IRR) and multiple on invested capital (MOIC). We measure and report these on a Net basis, meaning what an investor actually receives after fees. By providing current and potential investors these key performance indicators (KPIs), we are able to more fully tell the narrative of what the return is from JLAM’s private real estate investments.

Your investment strategy and appetite for risk generally dictate what the expected return is for your private real estate investment. Generally, riskier investments tend to offer higher returns as investors require more potential upside in exchange for the added risk—the risk-return tradeoff argues invested money renders more attractive returns when there is an increased possibility of losses. Risk and return are intertwined, but it is a non-linear relationship where various factors can influence how risk translates into returns. To that end, our primary focus is finding opportunities where we can actively manage the risk and maximize the return of an investment, so our holy grail is to discover opportunities that may have elements of perceived risk, that we can de-risk by applying one of many tactics, that also have high expected returns.

When evaluating investment opportunities, we consider IRR and MOIC, although both have different purposes. IRR takes into account the time value of money and represents the annual equivalent of what rate of return you stand to make. On the other hand, MOIC measures the ratio of the amount you (are expected to) receive relative to the amount you put in, regardless of the investment’s timeframe.

The speed at which returns are realized is an essential factor in calculating IRR. For example, receiving $2,000,000 in one year for $1,000,000 invested today is far more favorable than waiting ten years for the same dollar return. The MOIC is identical, but the IRR differs significantly.

.png?width=2100&height=1500&name=JLAM%20-%20IRR%20return%20post%20V3%20(1).png)

However, there are instances where a transaction may yield a lower multiple, such as quickly receiving $1,300,000 for every million invested (1.3x MOIC compared to the 2x one from the example above), but the IRR could be significantly higher. The appeal in this case lies in the ability to recoup the investment, realize the gains, and redeploy funds quickly.

Therefore, we strike a balance between a minimum IRR and MOIC. It's important to avoid situations where a high IRR is achieved, but the returns are minimal, as this would require a significant effort for little absolute dollar gain.

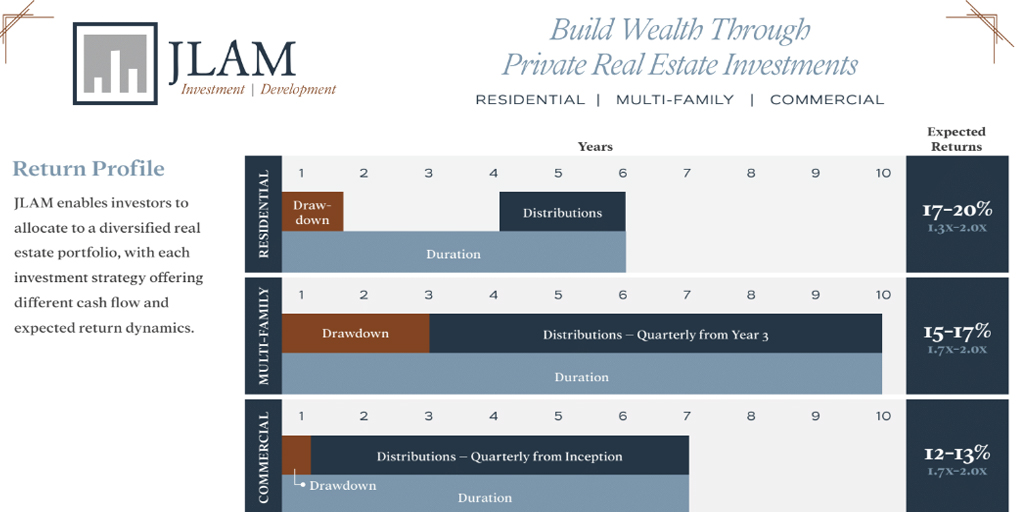

Each investment strategy has its own IRR and multiple targets. Typically, our multiples range from 1.4x and above, and our IRR is, on average, in the double-digit range. For for-sale residential development deals, the IRR is typically in the high teens to low 20s, with an MOIC of 1.3-2x. Commercial and multi-family transactions, being longer in nature, have MOICs between 1.7-2x and IRRs of 10-15%. Our figures represent net returns to the investor after deducting fees and carried interest to the general partner.

It is also important to note the return profile of each strategy varies, including the time it takes for the investor to contribute funds and receive their first distribution. If we acquire an existing asset with tenants in place, we start generating income from Day One, resulting in quarterly distributions from the beginning. However, for large development projects that could take several years to stabilize, there will be no income during that period, and distributions will only commence once income starts flowing. The investment strategy of the asset dictates the distribution timeline.

What sets our private real estate investments apart is the level of flexibility we offer investors. We work closely with an investor (and their advisors) to structure and select opportunities that align with their portfolio objectives. It is important to find the right balance between risk and return, and that requires considering personal objectives, risk tolerance, and time horizon. Whether someone wants to diversify across various real estate types or focus on a specific sector like for-sale residential, commercial, or multi-family, we can present investment options that match their goals.

If a particular investment doesn't meet their requirements, we typically have other opportunities in the pipeline that may be a better fit. Ultimately, the investor has the discretion to choose the opportunities that suit their portfolio best. This approach allows them to reap the benefits of private real estate investments while maintaining control over what works best for them.

As always, we have an investor-friendly approach that features a very clear and limited fee structure, unlike some of our competitors who charge a full gamut of fees (which can have a material negative impact on the returns you actually receive). In most cases, we simply charge a development or asset management fee, which typically ranges from 1-2 percent of the equity raised. There may be an additional fee depending on the unique circumstances of a project, but if this occurs, additional fees are clearly disclosed and explained upfront.

Again, unlike our competitors, our primary compensation component is the performance fee (also known as carried interest). This aligns our interest with our investors, as we win when our investors win. Keep in mind, though, our investor’s money is paid out before our performance fee—our performance fee is subordinate to investor funds. We tailor the waterfall structure of the partnership based on the investment strategy and risk profile of the asset, which provides even more alignment. Last but not least, we invest a significant amount of our own money alongside our investors in every deal, and our money is treated the same as our investors’ money. This multi-pronged approach to alignment is one of the many reasons our investment partners have continued to work with us for over 10 years, with our investment reup rate close to 100%.

To learn more about what returns we offer in our private real estate investments, please schedule a meeting with us.

All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results, and there can be no assurance, and clients should not assume, that future performance will be comparable to past performance. Metrics updated as of June 30, 2023. JLAM does not provide tax, legal, investment, or accounting advice. This website has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, investment, or accounting advice. You should consult your own tax, legal, investment, and accounting advisors before engaging in any transaction. Any third-party information contained herein is from sources believed to be reliable, but which we have not independently verified.