Within the next three years, over $1.5 trillion in real estate loan maturities will occur, and with 32% of all commercial real estate loans held by regional and community banks, there will be a dire need to find lenders. Unfortunately, asset owners will face tough decisions because the 11 interest rate hikes since March 2022, and associated consequences from them, have caused the majority of lenders to tighten standards.

These market dynamics in lending are driving a significant dislocation and creating distress in multiple segments of real estate—which can lead to generational investment opportunities for investors with capital at-the-ready. Read more to learn what a real estate fund is, and how it allows you to take advantage of this period of market dislocation.

A real estate fund is a pooled investment vehicle that aggregates investor capital and invests in, or acquires, a portfolio of real estate assets. There are a variety of types of strategies pursued by real estate funds, ranging from “Core” (lower risk) to “Opportunistic” or “Distressed” (higher risk). A typical “Value Add” or “Opportunistic” real estate fund invests in underperforming real estate assets, or markets that are experiencing cyclical downturns, with the goal of improving their value and generating higher returns. These funds can offer investors a variety of investment strategies to choose from, depending on their individual needs and risk tolerance.

There are several benefits for sophisticated investors, RIAs, and family offices to invest in a real estate fund. For starters, certain types of real estate funds typically have the potential for higher returns. They can also help to diversify portfolios by adding exposure to private real estate rather than relying solely on traditional—and volatile—bonds and stocks. And real estate funds are typically managed by professional investment teams that should have the skill to identify and execute on investment opportunities.

It is important to note, though, as with any investment, there are some risks too.

Portfolio Management Research argues that “funds rely heavily on the skill and expertise of the fund managers.” This can be seen as a risk if you invest with the wrong partner. If this happens, you can face some of the following problems:

Beyond these issues, one concern about real estate funds is they are typically illiquid, meaning you cannot easily withdraw your money. This is yet another reason it is critical that you choose the right real estate investment partner to invest with as it can be a longer-term commitment.

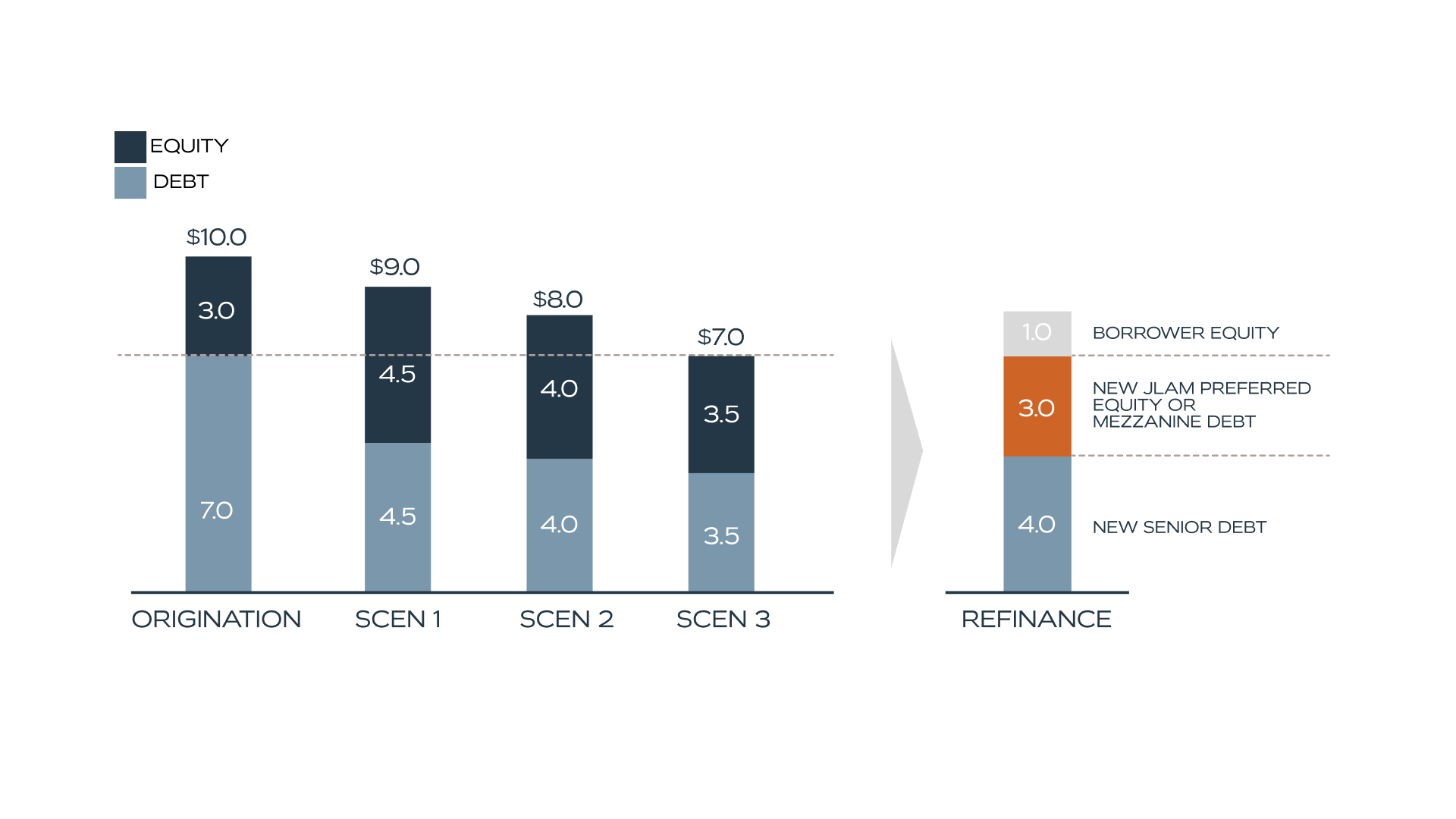

A real estate investment fund’s strategy is designed to deliver attractive risk-adjusted investments by capitalizing on the market dislocation. With much tighter lending standards, many borrowers will require new cash infusions to protect their remaining equity. For example, in the above graphic, when the borrower acquired the asset three years ago, the property value was $10 million. The lender originally gave 70% loan-to-value (or LTV, the amount of your mortgage compared with the value of the property), meaning the $10 million property was acquired with $7 million in debt and $3 million in equity.

Fast forward to today, and if property values decrease because of market instability, as shown in Scenario 1 the property value could become only $9 million. In this case, because market conditions have changed, if the lender is willing to provide a loan extension, they may only provide a loan of 50% of the property’s new value ($9 million), for new loan funding of $4.5 million. The borrower still has $2 million of equity to protect. Therefore, they will want to refinance to protect their initial investment, but this means there is a $2.5 million (the difference between the $7 million existing loan that needs to be paid off and the $4.5 million new loan funds available) gap in the capital stack.

The same is true for Scenario 2, where the borrower still has $1 million in equity to protect. In this case, because the property’s new value is $8 million and the lender is only willing to loan at an LTV of 50% ($4 million), there is a $3 million gap in capital. Scenarios like 1 and 2 above illustrate great examples of opportunities for favorable returns by providing preferred equity or mezzanine debt solutions to qualified borrowers on fundamentally strong real estate assets to fill the financing gap.

However, what happens if the property value falls to $7 million or below? In these scenarios, this hypothetical borrower has no remaining equity in the property. The borrower and the lender are in a tough position because the property is under water, the borrower has no reason to continue funding or operating the property, and the lender has no desire or capability to own and operate the property. Scenarios like this provide a tremendous opportunity to purchase distressed debt or discounted loans. A fund can acquire the loan, or buy the property outright, at a discount from the lender and unlock significant value if the fund’s management has expertise as an operator.

Finding opportunistic real estate investment opportunities is made possible by a firm utilizing their extensive network and strong reputation to access these opportunities, and having the committed capital of the fund provides certainty of close for the seller (lender) and the most favorable pricing for the fund and its investors.

At JLAM, we use many different real estate investment strategies, so we can be the secure, trusted partner you deserve to find these undervalued but high-potential assets. Our approach, team expertise, and proven success combine to set us apart from the competition.

Our focus is on the Mid-Atlantic and Carolinas regions—two areas our managing principals, Nick Hammonds and Doug Motley, have successfully invested in for more than 10 years. Hammonds and Motley have an established sourcing network that enables them to have access to premier real estate opportunities.

Importantly, as opposed to some other real estate investment firms, we prioritize minimal fees and high transparency for our investors. We are not charging a full gamut of fees (which can have a material negative impact on the returns you actually receive), but a simple annual management fee. This helps maximize your return.

JLAM leverages its agility to design investment strategies that are best suited to capitalize on the most favorable opportunities in the market. For example, a real estate fund could provide an attractive investment opportunity for taxable and non-taxable (retirement plan) investors. Funds that utilize what is called a "REIT blocker” (incorporating a REIT entity in the organizational structure) can offer several tax-related benefits that may include not having to file multiple state tax returns at the investor-level, having no unrelated business taxable income (UBTI) issues, and a potential for 20% deduction on qualified dividends.

Another reason you should choose us is our proven ability to pick winners from losers. One critical part of this is how we are able to mitigate risk through our deal structure. When we make preferred equity or debt investments, we have the right to take over an asset if a borrower were to default. This is a critical aspect of our risk management, where JLAM is uniquely positioned, because if we take over an asset, we have the hands-on, operational skills that enable us to unlock a property’s value. This—along with our expert legal team that protects our rights as a capital provider and our significant experience as a borrower that helps ensure appropriate terms and deal structure—is another way we help maximize value for our investment partners.

In fact, our managing principals successfully invested in a series of real estate funds in the last downturn (around 2011). Their ability to see what others can’t helped them deliver strong risk-adjusted returns to investors, even in that period of great economic instability.

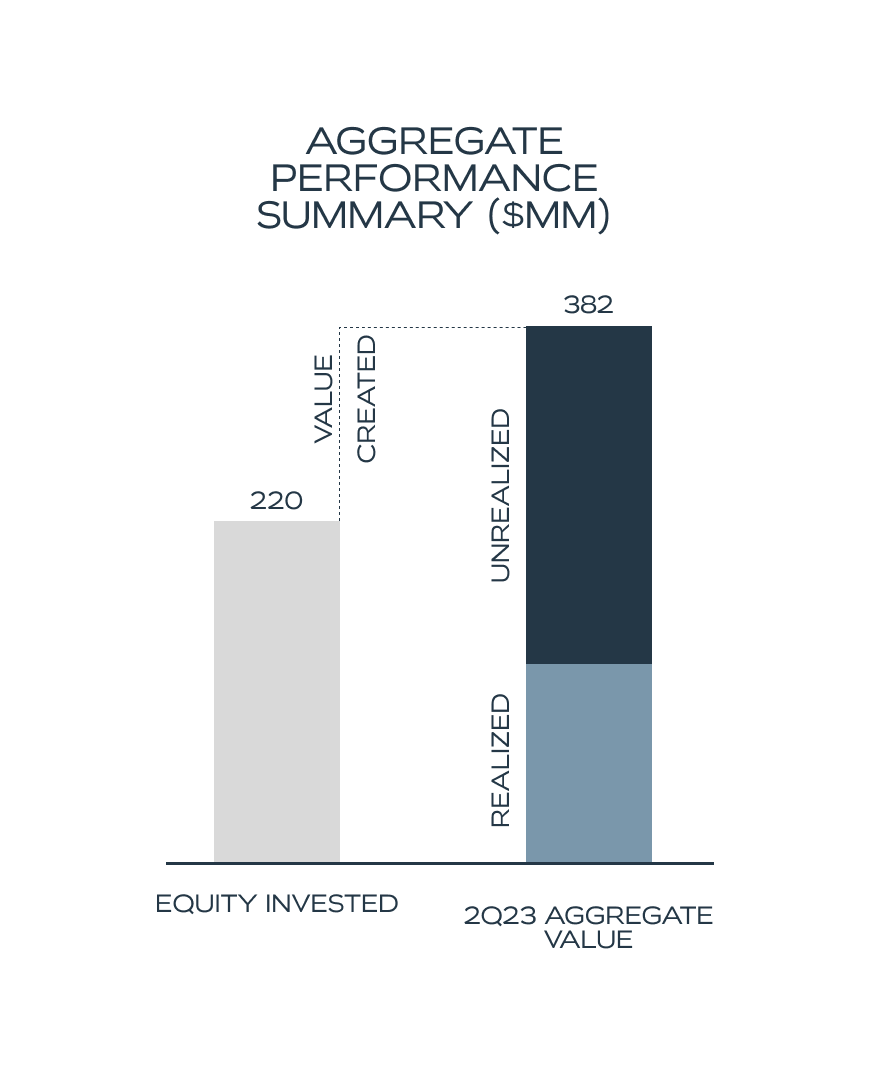

These factors, among others, have created our strong track record. Since 2011, JLAM has deployed more than $400 million in capital and developed more than 2,500 lots and 1+ million square feet of commercial real estate. Through this, our completed projects have delivered an average Net IRR over 19 percent and an average 1.9x Net Multiple, which has led to very satisfied investors as evidenced by our investor re-up rate approaching 100 percent.*

If you’re interested in learning more about real estate funds and our investment strategies, schedule a meeting today to speak with one of our managing principals .

*All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results, and there can be no assurance, and clients should not assume, that future performance will be comparable to past performance. Metrics updated as of June 30, 2023. JLAM does not provide tax, legal, investment, or accounting advice. This website has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, investment, or accounting advice. You should consult your own tax, legal, investment, and accounting advisors before engaging in any transaction. Any third-party information contained herein is from sources believed to be reliable, but which we have not independently verified.