Flywheels are used for the storage of kinetic energy. It’s a momentum device that stores and releases kinetic energy in order to keep a machine operating smoothly, operating without dramatic increases or decreases in speed.

How is a mechanical device like a flywheel applicable to an investment strategy? Investors fear volatility. Significant swings in returns or valuations make it hard to quantify if an investment makes sense or not. Investing in a volatile market requires timing, and since no one can see the future, despite what some investment managers promise, investment market timing is extraordinarily difficult to execute well.

Any investment strategy that harnesses value-creating momentum, and transforms that momentum to deliver better-than-average returns is worth a closer look.

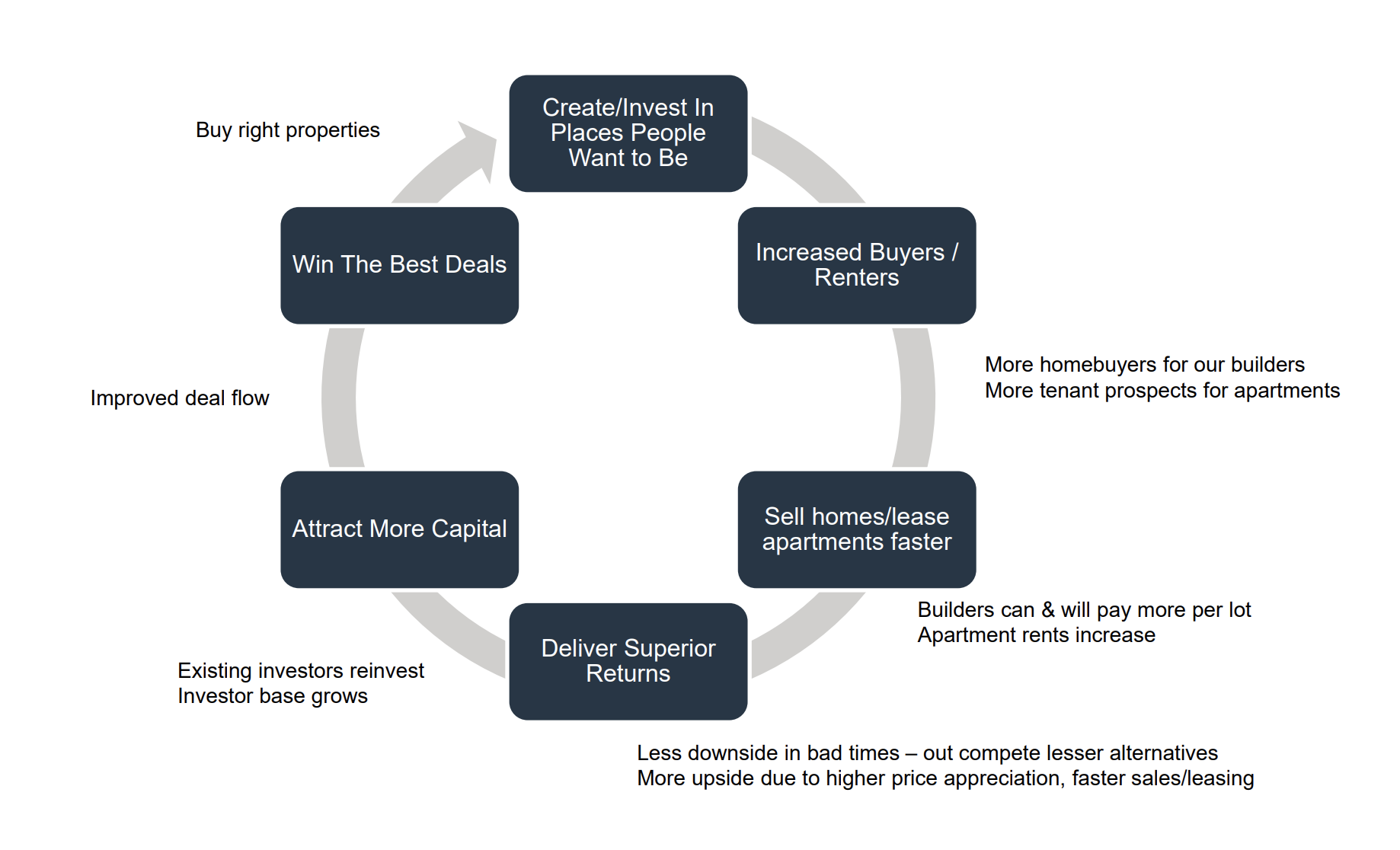

We recognize and harness the immutable psychology of people, by understanding how they make decisions and apply personal value to the places that they live and work.

Getting this right means that we simultaneously create a value proposition that, when compared to available alternatives, commands a premium sales price or rent, while reducing sales or rental friction, keeping occupancy rates high, or selling out projects quickly.

These dynamics improve and accelerate return on investment on any given project, making our deals more attractive to investors. The ability to attract an abundance of capital means that we’re positioned to capture and execute on opportunities when they arise.

This market positioning results in brokers and sellers knowing what we’re looking for in properties and wanting to work with us because we have the capital and expertise to execute.

Our Flywheel Strategy is codified in our Purpose and Core Values, which have been honed over our 10+ years of operation, as we’ve learned what matters in real estate investing.

We’ve learned that the same approach works equally well in commercial real estate, for sale residential real estate, and multi-tenant residential rental projects. An attractive feature of this investment model is that as macroeconomic uncertainty increases, the model still works and keeps risk at bay.

If you're interested in learning more about our flywheel approach, schedule an appointment with us today.

All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results, and there can be no assurance, and clients should not assume, that future performance will be comparable to past performance. Metrics updated as of June 30, 2023. JLAM does not provide tax, legal, investment, or accounting advice. This website has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, investment, or accounting advice. You should consult your own tax, legal, investment, and accounting advisors before engaging in any transaction. Any third-party information contained herein is from sources believed to be reliable, but which we have not independently verified.